Ever since the larger not built for cloud ERP platforms transitioned to the cloud, a lot has changed in the ecosystems of business solutions. The cloud promised disruption, change and growth for everyone, however it brings a lot more disruption for the implementation partners than expected.

The promised flexibility, remote access, always current technology, world-class security, turning Capital Expenditure (CapEx) into Operational Expenses (OpEx), and general peace of mind is working out well for customers. Cloud providers are not complaining either, after seeing their businesses and bank accounts grow faster than ever seen in history. Many implementation partners at the other hand have been struggling over the past 7-8 years to adjust their business to the subscription and cloud economy, and the struggle is not going away.

Their business models for new software license sales already shifted from a perpetual license fee with annual maintenance, to a monthly subscription fee that includes fixes and updates (delivered by the cloud providers). While the new recurring revenue model has reduced swings in revenue, more changes are happening that directly impact the bottom line.

Is history about to repeat itself?

During a recent conversation with a few business colleagues, a comparison between the mainframe era and today’s cloud model was made. While it is perhaps a bit strange to compare a mainframe to the cloud, there are surprising similarities. Back in the day, the mainframe was the one and only computer most people worked on, and users accessed applications and computing power through a direct ethernet connection. Today we access our applications and computing power through the Internet. While current solutions are a lot more sophisticated and user-friendly than the green screens of the 70’s and 80’s, the control and management of systems is back in the hands of a few large corporations like Google, Amazon, Microsoft, Oracle, SAP and fast growers like Alibaba, Salesforce, ServiceNow and Workday—very reminiscent of the heydays of companies like IBM, Univac, DEC, Wang and General Electric as some of the mainframe providers. Today we can work from anywhere using a desktop, laptop, tablet, phone or even a wearable to connect to the cloud. These devices have apps, tools, functionality, and most of all an unmatched user friendliness that was never a part of the mainframe days. All this makes a big difference in the overall roll out and support of organizational digital transformation processes.

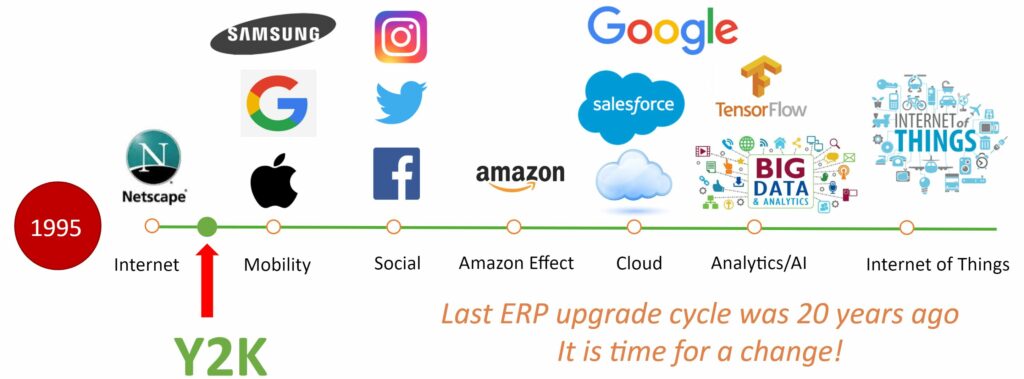

Just as hardware, software and technology has evolved over the decades, so has the model for services to implement and support business solutions. In the mainframe days, consulting services and system maintenance was typically handled by the hardware and software companies. As the market grew rapidly (especially in the 90’s leading up to Y2K), indirect sales channels were developed to service customers and a whole new segment of businesses emerged – Channel Partners made up of Value Added Resellers and Implementation Partners with revenues stemming from hardware and software sales, as well as implementation and ongoing support services. What we see emerging today brings us back full circle to where infrastructure, software and services are now all delivered by the cloud providers, and the revenue model for the channel’s implementation partners has begun to erode back to the initial solution implementation and not much more after that. There’s no question that the recurring revenue stream from software subscriptions is attractive, but with larger systems that have longer sales cycles, it takes a while to get a decent number of customers in the cloud. Then once the ERP or CRM implementation projects are completed, partner activity is diminished as the cloud partner takes over system management, backup and recovery, general maintenance, and updates.

The evolution of the partner community

In recent years we have seen a consolidation in ERP partner channels in part because of the reduction in work for partners, but many just didn’t have the capacity, interest or insight to adjust their own businesses – and this will continue to happen in the foreseeable future.

Channel Partners who adjust their focus from ERP and CRM implementations to models that use new technology tools available on the various cloud platforms and use the industry 4.0 tools such as AI, ML, and IoT will stay relevant. They can further use their deep industry knowledge to help their customers turn their traditional business model into IT platforms. Digital Transformation is not just about moving the systems into the cloud. The transition to industry 4.0 means your employees, suppliers, customers, and ‘things’ become more productive with intuitive and future-proof software solutions that gives them the opportunity to adjust to our ever-changing world.

“We have seen two years’ worth of Digital Transformation in two months”– Satya Nadella, CEO Microsoft –

Global pandemic accelerates change

The world has never seen as much change and adjustment as it did in 2020, where companies were forced to pivot rapidly and adapt to challenges brought on by the global pandemic. The lockdowns and shutdowns unfortunately extended too long for many businesses, for others their technology platform wasn’t ready, or they were in an industry where it was too difficult to fully adjust to rapidly emerging business requirements. Collaboration tools such as relative newcomer Zoom along with Microsoft Teams, Google Meet, WebEx, Slack, and several others flourished as they allowed us all to work from home, while more and more organizations kicked off their delayed Digital Transformation or general cloud plans. Behind much of this change in business was Consumers – they shifted and shifted quickly. Pandemic restrictions and working from home meant everyone started to shop online for curbside pickup or home delivery. Many used technology platforms they were already familiar with like Amazon, Netflix, Doordash and their online banking tools, and as the graph below shows, online e-commerce businesses did really well. The American market likely differs from the experience in other countries but it shows a significant jump in online sales in the largest economy on earth.

Retail e-commerce sales in the US market increased drastically in 2020. The total e-commerce sales for 2020 were estimated at $791.7 billion, an increase of 32.4% from 2019. (Source: US Census Bureau News)

This also meant a significant shift for businesses. While the cloud providers initially were offering Infrastructure as a Service (IaaS) and Software as a Service (SaaS), they are now rapidly expanding in the Platform as a Service (PaaS) space. It is not only the ERP providers such as Microsoft, SAP, Oracle, and Infor, but we see also Google Cloud and Amazon Web Services entering the space. While the last two are not likely to develop an ERP, they will use their infrastructure, solutions, tools and general reach to engage with businesses they are not working with yet and attract more business users to their clouds through industrial cloud and business apps. This gives business users the opportunity to select and use best-of-breed solutions offered by a fast growing variety of tested and approved providers. The same way we download our favorite apps on our phones for our specific personal use, the use of industry specific business apps will reduce the complexity of business software implementations. This also introduces further changes in the implementation landscape where a shift to Consulting as a Service (CaaS) is already under way.

In addition to a reduction in overall services, some larger system integrators have begun to offer their ERP and CRM implementation services as a subscription model, the same way as some made for cloud ERP providers are offering, and effectively turning the typical CapEx for implementation services into an OpEx for the customers. Large consulting and system integrator firms with deep pockets are financially much better positioned to transition to this model. For the medium and smaller players, it will become more difficult to hang on while bankrolling and adjusting again to another revenue model.

The gig economy effect

Large system integrator organizations, cloud organizations as well as customers have already tapped into the available talent in the fast-growing gig economy and are purchasing or securing talent offered by solo-preneurs and boutique firms. The pull of these organizations on talent still employed at the smaller firms, will only get stronger over time. In industry 4.0, the source of serious, high-quality talent is no longer other businesses, but rather consulting services offered by independent consultants as a “per drink” order, similar to the Uber model. It sounds perhaps unreal for those who have kept their head down for the rapid change in the industry, but workforce fragmentation will drive a massive change for the implementation partner community, especially now that working remote has been proven as an acceptable model.

What the future holds for ERP and CRM implementation partners in the cloud

With the Internet as the computer, the cloud can be as good for implementation partners as it is for the cloud providers and customers. It creates new markets, services and business models that create customer stickiness, and helps business valuation.

“Don’t be like a mediocre race car driver who sits in his car, looks in his rear-view mirror, sees his competition, and is so far behind that he thinks he is first.”– Paul Rulkens, High Performance Expert –

For many implementation partners it is time to shift, expand, and time to take control of their own destiny where they can add much more value than just implementing software. There are many great companies that need the new skills and tools that only can be provided by partners who have the industry-specific expertise to help their customers scale.

“On the road of this digital journey to Industry 4.0 we will see that those disruptive business processes, on top of (some) legacy ERP, will double the EBITDA, propelling double digits growth and increase market caps by 5 to 10 times of what it was on older technology. This is the place to be for the new Unicorns.”

– Jan Baan, Chairman & Founder Vanenburg Group –

As of March 2021, there are more than 600 Unicorns in a broad variety of industries, according to CB Insights. (https://www.cbinsights.com/research-unicorn-companies). “Unicorn” is a term used in the venture capital industry to describe a privately held startup company with a value of over $1 billion.

Many of the solutions offered by these companies require implementation partners who are ready to adjust from project-based work to a subscription services model and embrace the Industry 4.0 tools, not to mention the opportunity to ride their coattails.

Instead of a few large projects a year, the model changes to numerous smaller projects, providing affordable and effective solutions for customers with a quick ROI. Vanenburg’s Rappit Composer micro apps platform and Rappit Developer rapid application development tool allows us to build no-code & low-code based solutions swiftly, offering a unique opportunity for partners to carve out their own niche in a much faster and more efficient way than previously possible.

If I’ve piqued your interest and you’d like to learn more, please contact me